Oracle for years has seemed impervious to cloud computing. First Larry Ellison dismissed it. Then he sort of touted it, his version at least. But all along, Oracle was growing nicely. The industry chatter didn’t seem to matter. Big companies buy big software systems.

Something changed this winter.

Oracle’s software license sales limped up just 2% in December, and the company blamed customer budget cuts and fears over the European debt crisis. Sales to Europe, Africa and the Middle East make up a third of Oracle’s revenues. The stock took an instant 8% hit, but perhaps more tellingly is 22% off its May 2011 high. Investors appear to be signalling that Oracle‘s recent woes are due to more than just stingy customers. Could it be true that big, hulking IT organizations are changing buying patterns?

Patrick Walravens, a veteran software industry analyst at JMP Securities, believes so. He just lowered his ratings on Oracle to “market performâ€. He blames the adoption of cloud computing by big accounts.

Walravens’s checks show a willingness of even the largest companies to buy cloud offerings from vendors such as Salesforce.com (this doesn’t surprise) and also privately-held, soon-to-go-public Workday. Walravens recently found one deal of 40,000 seats won by Salesforce from Oracle. He believes it isn’t the largest. Salesforce reports earnings this Thursday. Marc Benioff, no doubt, will mention these deals if he can. Workday, similarly, has won several large deals with 50,000 and above seats.

Both companies are much smaller than Oracle but pose a larger, longer-term threat. Salesforce is aiming to be a technology platform for selling all sorts of business software. Workday has grown sales impressively selling software to manage employees, but is aiming to extend into financials, too.

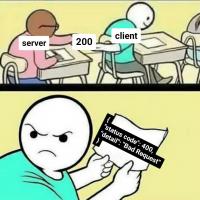

Meanwhile Walravens makes Oracle’s cloud effort sound like a tangled mess. The company did two large acquisitions of Web software firms: RightNow Technology and Taleo. These will take a while to make any difference. Then more immediately, Oracle has its own “public†clouds. There are nine of them straddling its universe of software offerings. And Oracle has several conferences launching in March to spread the message. But this technology is anything but live. Walravens tried to log in t one and got this message:

“When you submit this form, your information will be placed into a queue for access to controlled availability services. We will be provisioning Java and Database services in batches over the next several months. Our Fusion Application services will be made available shortly after that. You will be notified by email when your instance is ready.â€

Ellison’s vision of success via industry consolidation may be at risk. His idea has long been to buy up most of the industry’s players, make them more efficient, upsell their customers on his other applications and the hardware to run it, and milk their maintenance revenues. Even though their technology may be dated, it is sticky. Customers can’t rip it out easily, so they’ll continue to pay the maintenance fees necessary to keep the stuff running. And they’ll buy Oracle’s underlying hardware stack to run it easily. This buys Oracle a brilliantly profitable cash flow to pour into its future.

But Walravens’s modeling suggests otherwise. He’s predicting that Oracle’s software maintenance revenue grows just 6% in the quarter ending this May. A year ago that same revenue line jumped 15% over the year prior. That’s a stunning difference. Walravens also has Oracle barely growing its new software sales while its hardware business shrinks because it lacks that “pull through†of customers from the software side of the business. Overall he figures Oracle’s revenues grow 4.2% in fiscal year 2012.

Sure, it’s just a prediction, but if it is anywhere near true it is a severe challenge to the business model Oracle has been thriving on.